Cyber Insurance Market Overview

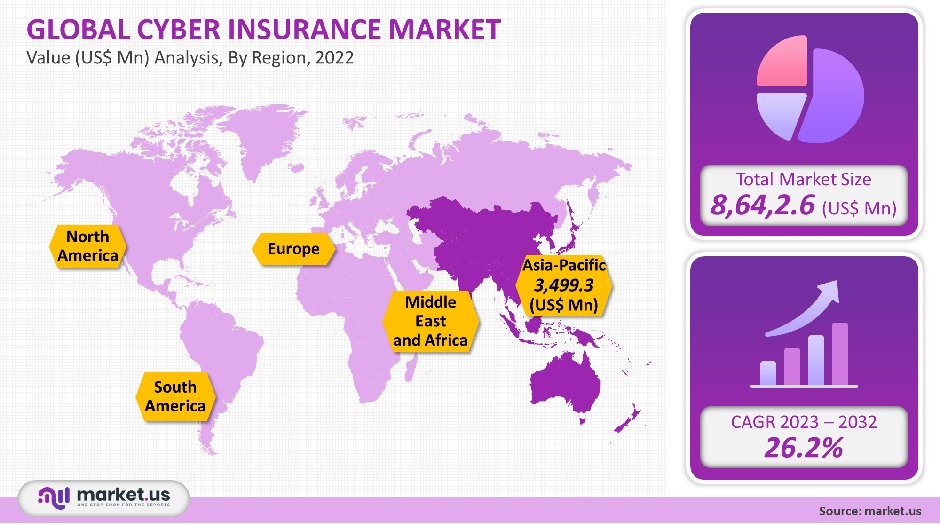

The global Cyber Insurance Market was valued at USD 8,642,2.6 million. The market is expected to grow at a 26.2% annual rate over the forecast period.

Cyber security is driven mainly by emerging online eCommerce platforms and the emergence of core technologies like the internet of things, artificial intelligence (AI), and cloud security. The market leaders focus on developing internet security solutions using artificial intelligence (AI). Fortinet, Inc., for instance, launched FortiXDR, an AI-enabled, fully automatic online cyber threat detection XDR system, in January 2021. With cumulative investments from Canada, Qatar, and France, the growing demand for solutions will gain momentum. Market growth is expected to be driven by the increasing use of enterprise security solutions in manufacturing, banking, financial and insurance (BFSI), and healthcare.

Cyber Insurance Market driving factors

Cybercrime is on the rise, and data breaches are becoming more common around the world. According to the Checkpoint report, there was a 93% rise in ransomware attacks in 2020, with 6 out of 10 companies affected. This substantial increase in cyberattacks will likely fuel the cyber insurance market growth.

Due to the large amount of customer data stored, hackers target industries such as retail, healthcare, and BFSI. These industries are at high risk due to digitalization, mobile banking, and online shopping. According to HIPAA Journal reports, 29.1% of monthly data breaches occurred in 2020. Companies across all industries invest steadily in data security to protect against loss. This insurance provides companies with comprehensive coverage that helps minimize attacks' impact. Cybercrime is expected to increase, which will drive various cyber insurance policies.

Cyber Insurance Market restraining factors

The demand for insurance is increasing due to the rising number of data breaches. The high cost of insurance policies will impede the market growth. Insurance companies are raising their premium costs, which makes it difficult to continue an insurance policy. As premium rates rise by 30%, companies like American International Group Inc. reduce coverage limits. Small and medium-sized businesses have a hard time investing in security insurance. The high cost of cyber insurance will impede market growth.

Cyber Insurance Market Key Trends

Technological advances drive cybersecurity insurance popularity in small, medium, and large industries. Businesses are also more likely to purchase cyber insurance policies due to increased media coverage of business attacks. Cyber threats are more strictly regulated, with stricter underwriting requirements and risk management stipulations. Regulations for cyber insurance will likely increase in the future, as more regulatory bodies will need access to cybercrime information.

Specific data collection requirements will need to be met for a standard reporting system to be accessible across the board. In the next few years, this will lead to the adoption of cyber policies by many organizations.

Cyber Insurance Market Recent Development

March 2021 – Axis Capital announced its partnership with Alpha Secure to provide small businesses with cyber security and software protection. This partnership will allow companies to offer small and micro-sized businesses innovative solutions.

September 2021 - The HSB of Munich Re Group introduced cybersecurity insurance and new collections for small businesses in Canada. The company will protect small businesses from increasing cyber risk.

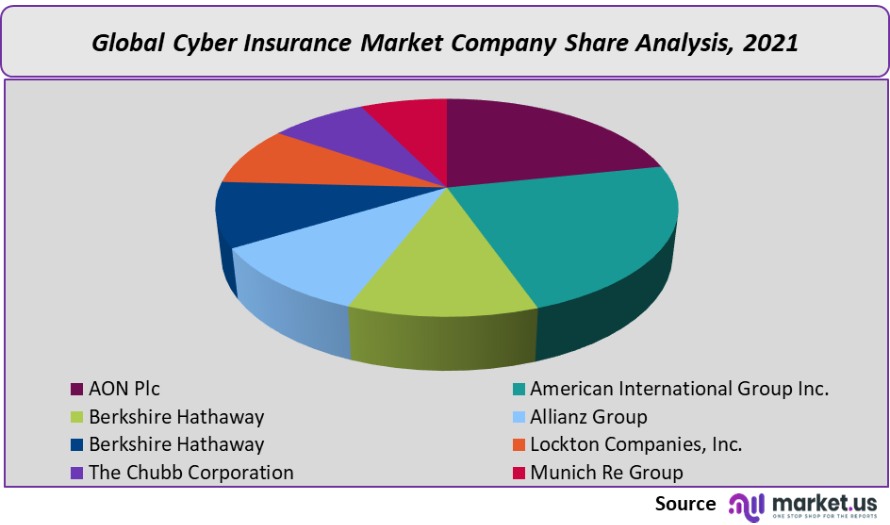

Cyber Insurance Market Key Companies

AON Plc, American International Group Inc., Berkshire Hathaway, Allianz Group, Berkshire, Hathaway, Lockton Companies, Inc., The Chubb Corporation, Munich Re Group, Other Key Players

Cyber Insurance Market Segmentation

Organization

- SMB

- Large Enterprise

Application

- IT & Telecom

- BFS

- Healthcare

- Retail

- Other Applications

FAQ

Q: What is the Cyber Insurance size in 2021?

Q: What is the CAGR for the Cyber Insurance?

Q: What are the segments covered in the Cyber Insurance report?

Q: Who are the key players in Automotive Cyber Insurance?

Q: Which region is more attractive for vendors in Cyber Insurance?

Q: What are the key markets for Cyber Insurance?

Q: Which segment has the largest share in Cyber Insurance?

Related Report

• Life, Pension, Health & Disability Insurance Market:-

Global Life, Pension, Health & Disability Insurance Market By Type (Term Insurance and Permanent Insurance), By Application (Children, Adults, and Senior Citizens ), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

• Homeowners Insurance Market:-

Global Homeowners Insurance Market By Type (Basic form, Broad form, Special form, Tenant's form, Comprehensive form, Condo form, Mobile home form, and Older home form), By Application (Enterprise, and Personal), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

• Agriculture Insurance and Reinsurance Market:-

Global Agriculture Insurance and Reinsurance Market By Type (Type I and Type II), By Application (Original insurer and Direct Insurance Company), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029